24+ Missouri Payroll Tax Calculator

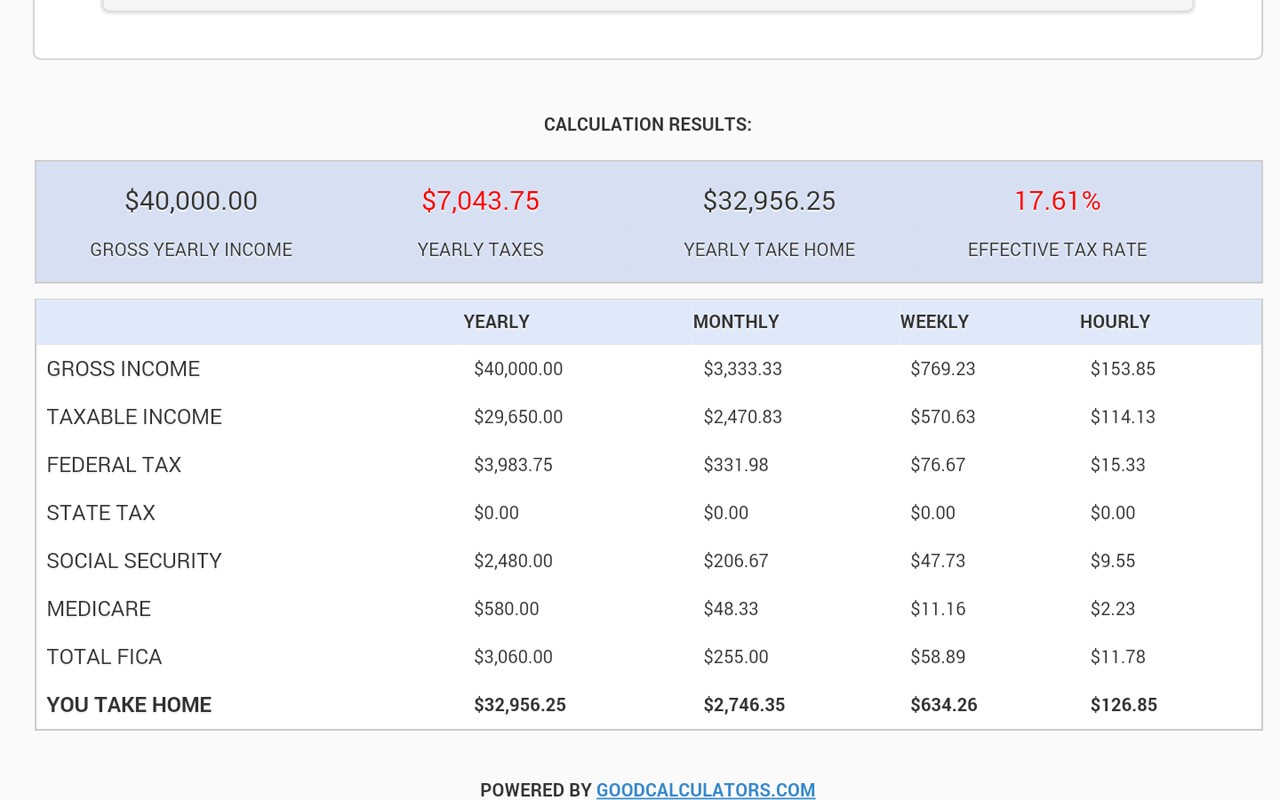

Employees can use the. Web The total taxes deducted for a single filer are 87768 monthly or 40508 bi-weekly.

Paycheck Calculator Take Home Pay Calculator

Web Social Security tax.

. Web The Missouri Salary Calculator updated for 2024 allows you to quickly calculate your take home pay after tax commitments including Missouri State Tax Federal. Heres how to calculate it. Web The state income tax rate in Missouri is progressive and ranges from 0 to 53 while federal income tax rates range from 10 to 37 depending on your income.

If the same single filer lives in St. New employers pay at a rate of 2511 and for non-profits the rate is 1. Web Taxes to withhold Your Missouri State Taxes to withhold are Need to adjust your withholding amount.

Louis or Kansas City his total monthly taxes will be 91114. Web This Missouri - MO paycheck calculator shows your hourly and salary income after federal state and local taxes. Web Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes.

Web Employers pay Missouri unemployment tax on the first 10500 of an employees wages. In an attempt to ease. Free for personal use.

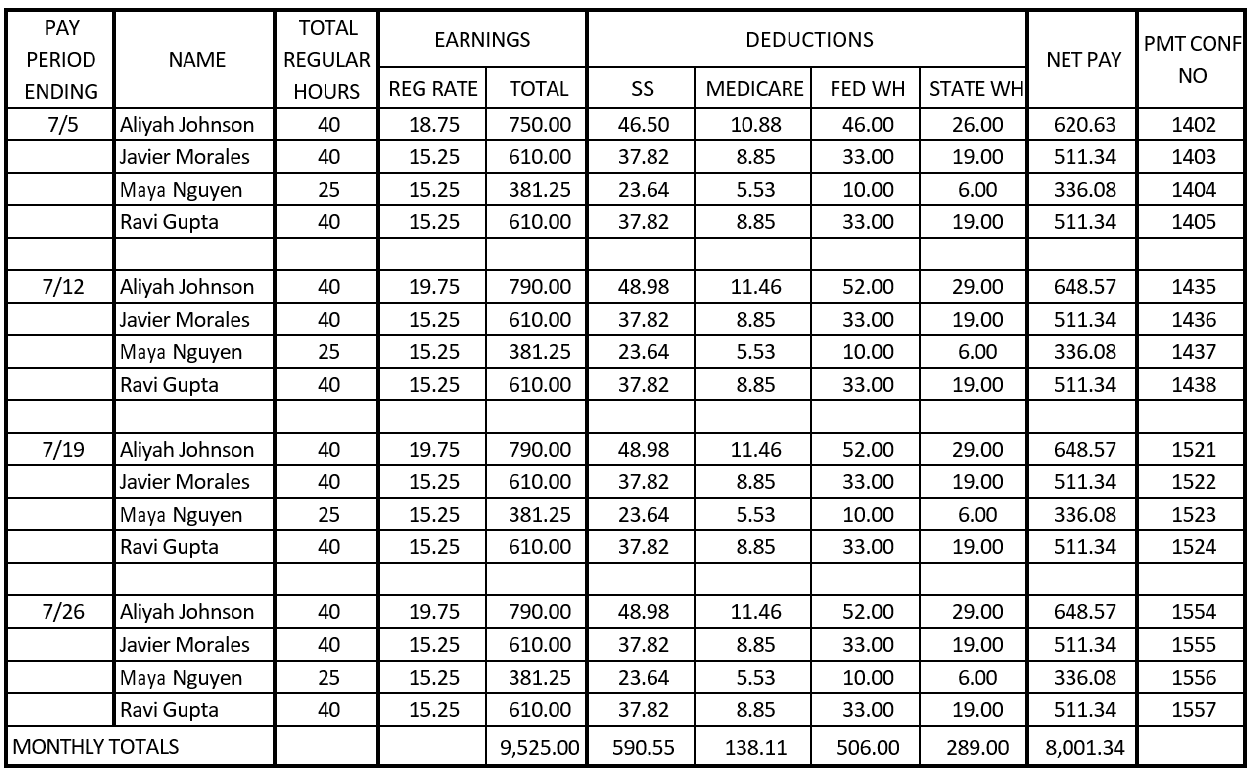

Web This is the gross pay for the pay period before any deductions including wages tips bonuses etc. You can calculate this from an annual salary by dividing the annual. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Its a progressive income tax meaning the. The new W4 asks for a dollar amount. Withhold 62 of each employees taxable wages until they earn gross pay of 160200 in a given calendar year.

Free for personal use. Web The Missouri Department of Revenue Online Withholding Tax Calculator is provided as a service for employees employers and tax professionals. Web Missouri paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check.

Thats where our paycheck calculator comes in. Using a Payroll Tax Service. Additions to Tax and Interest.

Web Effective for tax year 2019 the federal income tax deduction taxpayers may claim is prorated based on the taxpayers Missouri adjusted gross income. Web Paying Payroll Taxes. The maximum an employee.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web Missouri Income Tax Calculator 2022-2023. Employers can enter an.

Taxes Paid Filed - 100 Guarantee. Enter an amount for dependentsThe old W4 used to ask for the number of dependents. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. New employers pay at a rate of 2511 and 1 for non-profits. Complete an updated MO W-4 and submit to your employer.

Web Important note on the salary paycheck calculator. Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. If you make 70000 a year living in Missouri you will be taxed 11060.

Your average tax rate. Web Employers pay Missouri unemployment tax on the first 10500 of an employees wages. Use Missouri Paycheck Calculator to estimate net or take home pay for salaried employees.

Web The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings starting at 15.

Capital Gain Exemption Under The Income Tax Act Learn By Quicko

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Isdb Data Financial Aid Csv At Master Tommulholland Isdb Github

European Social Enterprise Monitor

Calameo 2018 Catalog And Student Handbook

Missouri Hourly Paycheck Calculator Paycheckcity

![]()

How To Calculate Payroll Taxes Step By Step Instructions Onpay

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

How To Choose The Best Value Hard Drive And Best Price Per Tb Get It Right First Time Nas Compares

Paycheck Calculator Take Home Pay Calculator

United States Salary Tax Calculator

Missouri Salary After Tax Calculator 2024 Icalculator

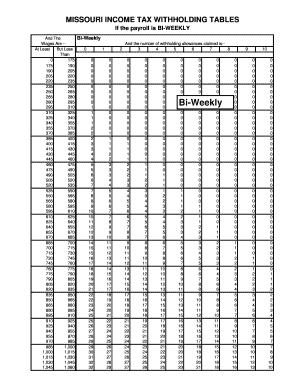

Fillable Online Dor Mo Missouri Income Tax Withholding Tables Fax Email Print Pdffiller

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

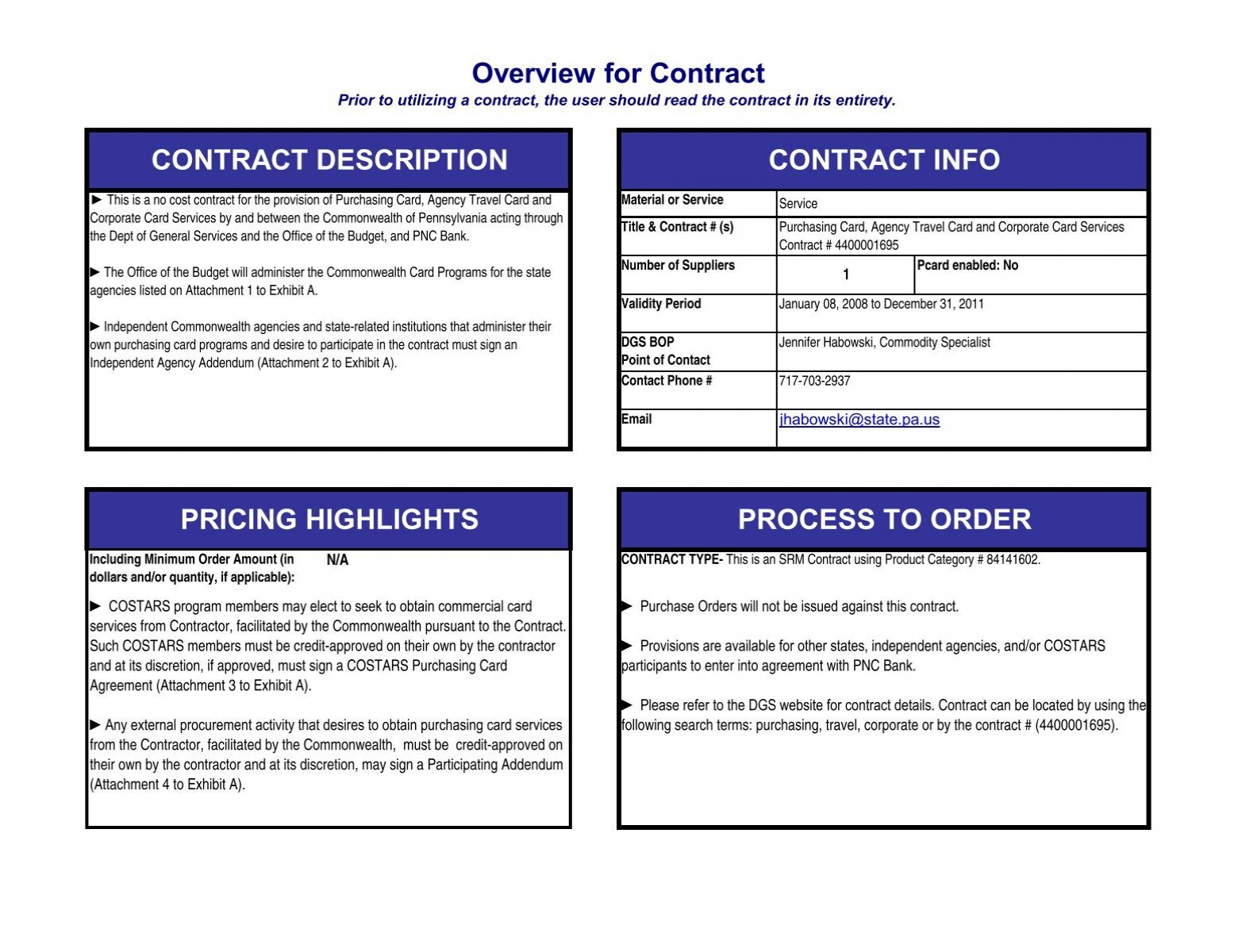

Pnc Contract Overview Department Of General Services

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide